Option Pricing with Stochastic Volatility, Equity Premium, and Interest Rates

Published in The Joint Mathematics Meeting, 2024

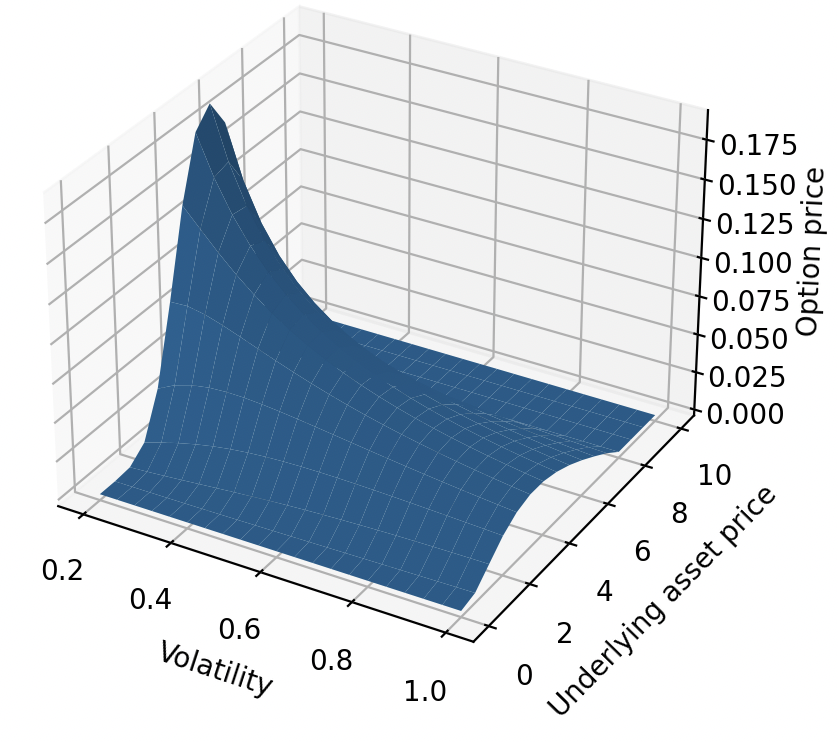

This research implemented finite difference schemes (Forward Euler, Backward Euler, and Crank-Nicolson) in MATLAB to approximate solutions for European and up-and-out barrier options, conducting convergence and stability analyses across numerical methods. The work was selected for presentation at the 2023 Young Mathematicians Conference and the 2024 Joint Mathematics Meetings.

Recommended citation: Nicole Hao, Echo Li, Diep Luong-Le. (2024). "Option Pricing with Stochastic Volatility, Equity Premium, and Interest Rates." The Joint Mathematics Meeting.

Download Paper